Joining forces for a speedy shift towards low carbon economy: Allianz and IDS @ OS-Climate Platform, COP 26 in Glasgow

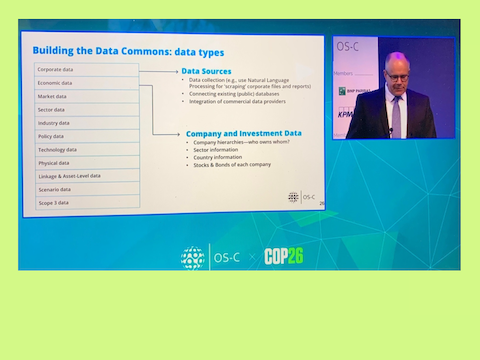

The Linux Foundation OS-Climate Platform presented itself at the UN Climate Change Conference in Glasgow with over 1.000 attendees. In collaboration with Academia, NGOs, Investors and Commercial data providers, OS-Climate provides a software platform that aims to aggregate the best available data, modelling and data science to boost global capital flows into climate change mitigation and resilience.

Reliable climate relevant datasets and science-based analytics are essential for climate risk management. Global leaders in sustainable finance and investment attended the event including Allianz Investment Management (AIM) / IDS GmbH Analysis and Reporting Services as a proud member of OS-Climate. The main idea of the event was to show that open data and open source tools – developed jointly by the sustainable finance community through transparently governed, systematized collaboration – will accelerate the transition to Net Zero.

With the main idea of the OS-Climate platform becoming a joint common data foundation for the transition to Net Zero, the Data Common session was kicked off by Thomas Kirchherr from IDS: “The challenges that people in organizations are facing with data and analytics made us join OS-Climate and collaborate with others through an open source approach to tackle the issue of inconsistent data.”

Christian Meyndt from IDS shared his knowledge on KPI extraction via rules-based and machine learning algorithms. Together with 1QBit and Allianz Investment Management SE, IDS has developed tools to extract and present data coming from unstructured sources, e.g. PDF reports. Christian stated: “Allianz and IDS have open sourced their solutions and contributed the code to OS-Climate in order to develop the tools in a collaborative way.”

Regarding the capabilities of building an open source portfolio alignment, Leyla Javadova from the ESG team of Allianz Investment Management SE, led by Udo Riese, gave an appealing introduction of the Implied Temperature Rise Model (ITR). The ITR is a forward-looking management tool that facilitates the evaluation of how individual investment decisions can contribute to long-term climate goals. The methodology has been set up compliant with the Portfolio Alignment Team’s considerations in the TCFD-Commissioned report “Measuring Portfolio Alignment”. It is a transparent, dynamic and science-based open source tool that incorporates backward and forward-looking data and covers multiple hard to abate sectors. ITR model compares companies’ emission trajectory with a given climate scenario and assigns a temperature score based on the alignment or misalignment thereof.

The event concluded with a “Call to Action” speech by Günther Thallinger, Allianz SE Board Member & Chair of UN convened Net-Zero Asset Owner Alliance. He emphasized that this COP26 conference – in which the private sector has been present like never before – is only the starting point for the financial industry to change and support the change: “We must move forward to transform CAPITALISM into SUSTAINABLE CAPITALISM.” Thallinger also highlighted the importance of having high quality climate risk data and reporting to ensure accountability.

Going forward, both Allianz Investment Management SE and IDS GmbH – Analysis and Reporting Services will continue the collaborative efforts to build open source data and analytics for a speedy shift towards a low carbon economy. By joining forces we can make a change.

“Allianz is committed to steering our investment portfolios to net-zero carbon emissions by 2050. High quality and reliable information about all the companies in which we are invested is the raw material for all decisions. Open-source analytics and open climate data is a very promising way to support the financial industry to fully integrate climate impact and work with the investee companies to transition to carbon neutrality. A huge thank you to all who are jointly working really hard on this key implementation effort, including our colleagues at AIM and IDS.” Günther Thallinger - Allianz SE Board Member & Chair UN convened Net-Zero Asset Owner Alliance